Health Insurance

Home » Health Insurance

Table of Content

Get life insurance today.

Health Insurance

What is Health Insurance?

Health Insurance offers coverage to the policyholder for medical expenses. It saves the policyholder in case of any health emergency. It covers all the medical expenses incurred by policyholders who own at the policy.

The medical expenses covered under the policy include the cost of surgery, drugs, treatment, and the services provided by the hospital. This provides financial stability to cover the cost incurred during a medical emergency.

In simple words, it provides reimbursement for medical expenses with a monthly payment of a small amount. Group health insurance falls under the employee benefit schemes, but the premiums are partially covered by the employer. In simple words, group insurance manages the welfare of the employees.

The policy chosen by the insured provides coverage for many medical expenses. This includes – Surgical expenses, Daycare expenses, and Critical illness, etc.

How Health insurance works?

Let’s assume in a city there are 100 people. Ravi is one among them. Ravi takes health insurance of 1Cr up to the age of 54 years, after which his son/daughter starts earning. Out of 100, the average number of people who become ill is around 15%. This means only 15 people claim from the paid amount. The Balance amount goes to the bank’s management operations.

Thus, the claim can be settled from the premium collected from other policyholders. This, just like sharing the risk of one individual with a huge group. This is how the life insurance industry runs. Unless a huge disease affects people, the insurance companies can settle claims.

Type of Health Insurance?

Insurance companies have catered to every need of their customers in the last decade. Hence, they have started introducing plans to suit the different needs of their customers.

1. Individual Health Insurance

This plan offers insurance protection with the below benefits.

- Cashless hospitalization

- Reimbursement of medical expenses

- Compensation for expenses for pre and post-hospitalization expenses

- Coverage for home treatment and much more

Add Ons can also be taken with Individual health plans. This enhances basic coverage of the insurance. The policyholder has to pay an extra amount besides the premium.

2. Group Health Insurance

This plan is generally taken by employers. This policy helps the employees to leave the concern about the health of their employees. The employees through their Medi-Claim policy can claim the expenses inured from the hospital itself.

This helps the employee to be more attached to the organization. As the employee doesn’t have to pay any premium directly.

3. Family Health Insurance

As the name suggests this plan is taken by an individual for his whole family. With this plan, the policyholders pay a single premium, and the sum assured becomes claimable for one person among the family.

If one person from the family faces illness, with the health insurance the particular person can claim the expenses.

Health Insurance and its benefits

Health Insurance is a financial investment that lets the investor save money spent on his health expenses. Let’s have a detailed discussion on its benefits below.

1. Medical expenses

Here, the primary objective is to provide the best health care service without relying on your income or savings.

It covers all the expenses from medical charges, medical bills, and costs of medicines, treatment, and other services that are incurred to treat the illnesses.

Thus, it takes away the burden of finance at the time of a medical emergency.

2. Coverage for critical illness

Apart from curable illnesses, there are other dreadful illnesses that require better coverage and incur long-term expenses

Illnesses such as cancer, liver failure, and brain tumor require intensive care (surgery, therapy, and transplant, etc.) These treatments incur a huge amount of money to be spent as medical expenses.

To cover such life-threatening health issues which come at a high cost an individual can opt for a health insurance policy.

Thus, when an individual gets a health insurance policy he receives a lump sum upon the diagnosis of the health issue that falls under the predetermined list under the policy.

Policyholders don’t have to spend their savings on the expenses, instead the same can be claimed with the insurance policy.

3. Cashless claim benefit

Nowadays several insurance companies provide the facility of the claim that involves cashless transactions.

This is applicable when the policyholder gets admitted to the insurer’s network hospitals. Network hospitals are hospitals that are in agreement with the insurance company for a health insurance policy.

In this case, the transaction takes place between the company and the hospital. The policyholder is not involved between them.

The policyholder can fill out the pre-authorization form using the health insurance card to avail of the cashless facility.

4. Extra coverage facility

Generally, every organization offers their employees health insurance cover but only till their employment with the organization. If the employee has to leave the organization the medical expenses can’t be claimed from the company.

There are many cases where the employees lose their employment as a result, they lose their health insurance coverage as well.

To avoid such problems, it would be an additional coverage to protect you and your family in terms of finance and risk.

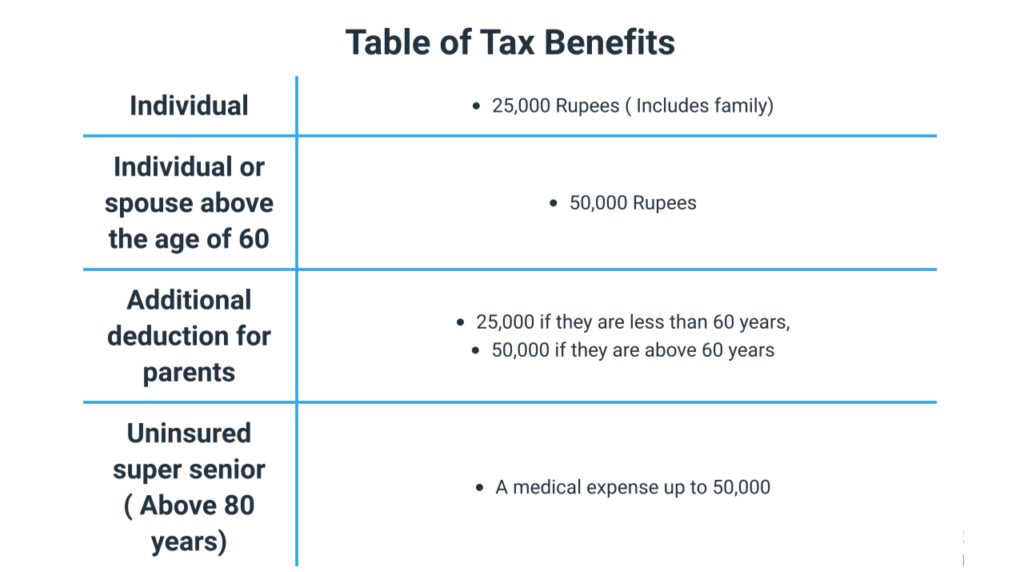

5. Tax benefits

One of the most familiar advantages is the tax benefits. There are various tax benefits depending on the age category. The premium paid under the health insurance scheme is covered under section 80D of income tax 1961.